For most people, 20s are supposed to be full of fun, adventure, travel, exploration and what not! Financial security is the last thing on their mind probably because they have plenty of time to worry about that. But if you want to set yourself up for lifelong success, you need to start early. The more you wait, the worse it gets!

Abide by these 5 rules in your 20s to be financially secure by 30s.

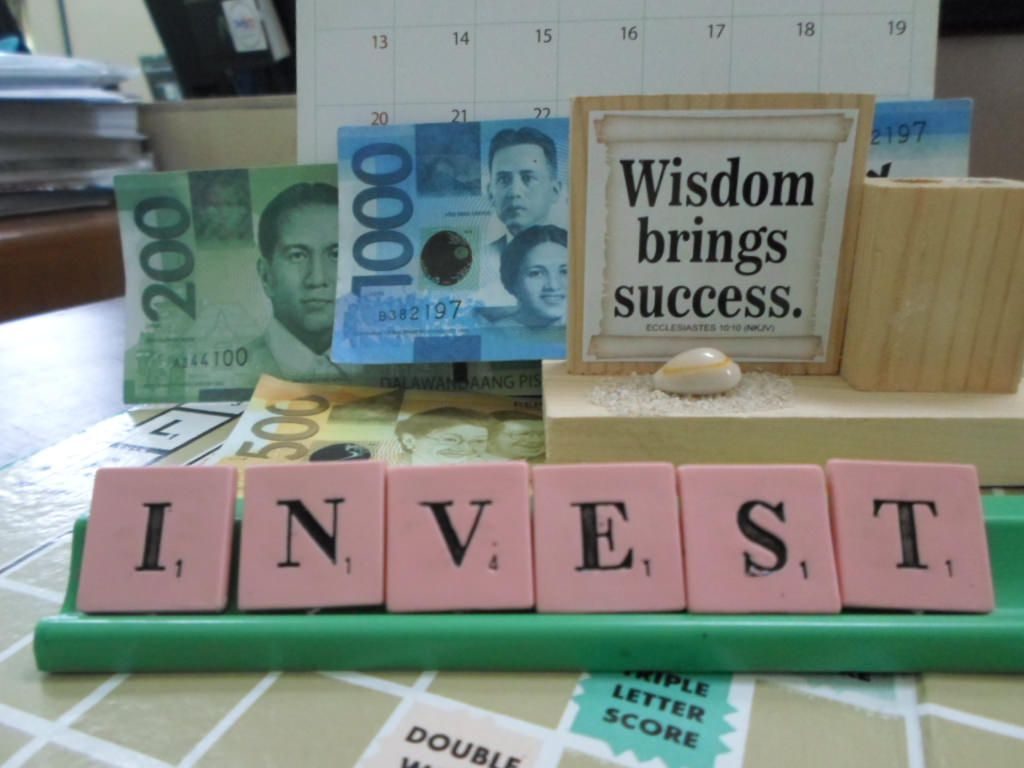

#1. Invest in yourself

This means both professionally and personally. On the professional front, you need to focus on your career and develop at least one marketable skill. Learn all you can from your current job even if you hate it. This will certainly help you get a better job. Or sign up for some professional courses or skill development classes. This is the best time to enhance your career and skillset.

At the same time, don’t forget to take care of yourself. Exercise, eat well and go to a doctor for annual check-ups. Your 20s are very hectic but don’t put health on a backburner during these years.

#2. Set short-term goals

You probably have many long-term plans/ dreams but what about your short-term goals? Setting long-term goals seems fun when we are full of hope but what we don’t realize is what life has planned for us on the next turn. So, it’s better to focus more on your short-term goals so that long-term gaols automatically take care of themselves. You can start with paying your credit card bill or paying off your student loans within the next two years. This way you will have more liberty when it comes to long-term goals such as buying a house.

#3. Live within your means

This doesn’t mean you stop having fun and start living like a miser but you need to strike a careful balance between things you need and things that just eat up your money. plan wisely if you are making big purchases. If you want to travel and this is good age to travel then start saving, don’t rely on credit cards too much. Want to buy a big screen TV? Save and make a budget and decide where that money will come from. Smart financial decisions during this age can lead to a sound financial future ahead.

#4. Gain Financial Literacy

You job may give you a decent package or it may not. But growing your financial wealth is a whole different game. Saving isn’t the only way to grow your wealth. You can also invest to make better financial decisions. But sound investment doesn’t come by chance. You need to gain some financial literacy before you start investing your money. Get acquainted with the concept of personal finance to make the best of your income.

#5. Borrow money only to invest

A golden rule of thumb is to never borrow to finance your lifestyle. That fancy car can wait! Don’t live your life just paying credit card bills. If you must borrow, make sure it is only for investment purpose. This may include investing in assets such as bonds/stocks or investing in yourself for education, any skill or to start a business.